Unlocking Success: The Deep Dive into Short-Term Rental Analytics

Key Takeaways

- Data-Driven Decisions: Short-Term Rental (STR) analytics are essential for understanding market trends, making informed investment choices, and optimizing property performance.

- Leading Platforms: Tools like AirDNA, Airbtics, and Mashvisor provide comprehensive data, from daily rates and occupancy to potential cash flow, guiding investors.

- Local & Global Insights: Analytics enable both broad market overviews and granular, location-specific data analysis to identify hidden gems and tailor strategies.

- Future Forecasting: Advanced tools, such as AirDNA's Rentalizer, offer predictive capabilities to anticipate future rental performance and adjust pricing.

- Impact of Regulations: Data analysis can reveal the actual effects of STR regulations, showing that well-intentioned policies don't always yield expected housing improvements.

The world of travel and investing is always buzzing, full of exciting opportunities and new adventures. One area that has really captured everyone’s attention is the short-term rental (STR) market. Think about all those cozy Airbnbs, spacious Vrbo homes, and unique vacation stays that travelers love! This dynamic sector is growing fast, attracting everyone from holidaymakers looking for a home away from home to smart investors hoping to find their next big venture.

But how do you make sense of such a vibrant and ever-changing market? The answer lies in something super important: Short-Term Rental Analytics. This isn't just a fancy phrase; it's the key to truly understanding what's happening, making really smart choices, and getting the most out of every rental property. In today’s fast-paced world, simply guessing isn't enough. You need clear, reliable information to spot trends, decide where to invest your hard-earned money, and make sure your rental properties are always performing their best. If you're curious about the bigger picture, discover property insights that can change your investment game1.

Imagine trying to navigate a new city without a map. You might get lucky, but you're more likely to get lost! That's what running a short-term rental business without good analytics feels like. Luckily, we live in an age where incredible tools and resources are available, ready to give us deep insights into every little detail of the STR market. From understanding daily rates to seeing how many guests are booking, these tools are changing the game for everyone involved.

In this exciting exploration, we're going to pull back the curtain on the incredible power of Short-Term Rental Analytics. We'll look at the top platforms, discover how they help investors find hidden gems, understand big market trends, and even peek into the future of rental forecasting. Get ready to embark on a journey that will show you why data is not just important – it's absolutely essential for anyone serious about short-term rentals!

Why Data is Your Best Friend in the STR World

The short-term rental market is truly a lively place. It’s always moving, always changing, and full of different opportunities depending on where you look and what time of year it is. For both experienced investors and newcomers, understanding this constant ebb and flow is absolutely crucial. Without a clear picture, making good decisions feels like trying to hit a target in the dark. This is exactly why analyzing data related to STRs is so important. It helps us understand market trends, make informed investment decisions, and even optimize rental strategies to ensure properties are always performing at their peak. To stay ahead, property data analytics are your secret weapon2.

Think of market trends like the weather. If you know a storm is coming, you'll bring an umbrella. If you know the sun will shine, you'll plan a picnic. In the STR world, knowing trends means you can see if more people are traveling to certain areas, what types of properties are popular, or if prices are going up or down. This helps investors choose the right places to buy and helps property owners set the best prices for their rentals.

But it's not just about understanding the past or present. Analytics also help us look into the future! Imagine being able to predict when your rental property will be most in demand, or which areas are set to become the next big hot spot. That’s the power of data. It helps everyone, from a single homeowner renting out a spare room to big companies managing many vacation properties, make smarter choices that lead to more bookings and happier guests. It truly transforms how people approach the entire short-term rental business, making it less of a gamble and more of a strategic play.

The Superstars of Short-Term Rental Data Analytics

In the vast universe of short-term rentals, certain platforms stand out like bright stars, guiding investors and property managers through the complex data landscape. These are the tools that gather, crunch, and present vast amounts of information in easy-to-understand ways. They are essential for anyone who wants to succeed in this exciting market.

Leading the charge in this space are platforms such as AirDNA. AirDNA is a big name, known for providing really comprehensive data analytics. It dives deep into the world of short-term rentals, covering everything from Vrbo to Airbnb listings. Think of it as a super-detective for rental properties, helping you understand how different homes are performing. With AirDNA, you can look at average daily rates, occupancy rates, and even revenue for properties in almost any market you can imagine. This gives users a powerful look at how well properties are doing and what kind of money they can expect to make. It’s like having a crystal ball that shows you exactly what’s happening in the short-term rental market right now3.

Another fantastic platform making waves is Airbtics. As its name suggests, Airbtics offers worldwide data, allowing users to analyze the short-term rental market across the globe. Whether you're interested in a small town in your home country or a bustling city on another continent, Airbtics has the data to help you understand market conditions. This global perspective is incredibly valuable for investors who think big and want to explore opportunities beyond their local area. It helps them compare how different regions perform against each other, spotting hidden gems and emerging trends before others do. Airbtics empowers users to see the bigger picture, helping them make strategic decisions about where to expand their short-term rental portfolio4.

Then there’s Mashvisor, which really hones in on helping investors find profitable properties. Mashvisor focuses specifically on short-term rental data analysis and Airbnb data, making it a go-to tool for anyone serious about identifying investment opportunities that promise good returns. What makes Mashvisor special is its ability to help users quickly search for and analyze potential rental properties, often showing them expected cash flow, cap rate, and other key financial metrics. It’s like having a personal guide that points you to the properties most likely to make you money, saving you countless hours of research. Mashvisor helps to demystify the investment process, making it easier for people to enter the STR market with confidence5.

These platforms are not just data providers; they are decision-making engines. They turn raw numbers into actionable insights, helping people understand everything from pricing strategies to guest behavior. With these tools, investors can move beyond guesswork, making data-driven decisions that pave the way for successful and profitable short-term rental ventures.

Seeing the Big Picture: Visualizing Market Opportunities

One of the most exciting aspects of modern short-term rental analytics is how these tools help users visualize complex data. It's one thing to see a table full of numbers, but it's another entirely to see those numbers come to life on a map, showing you exactly where the opportunities lie.

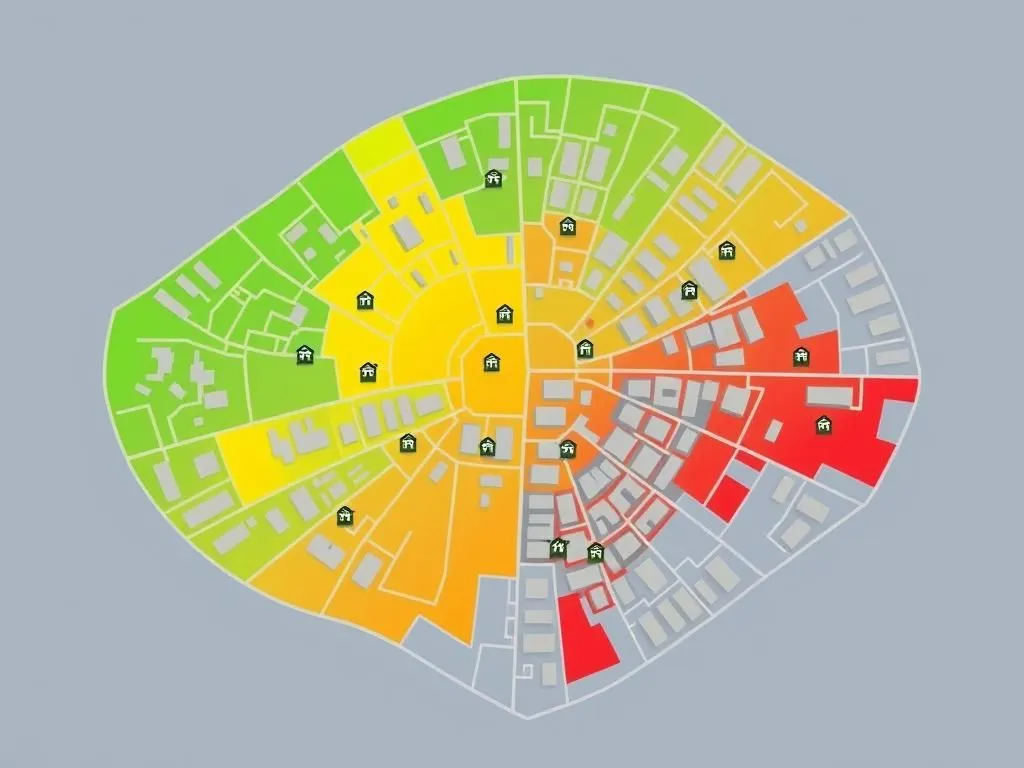

The image below perfectly illustrates this power, showcasing how a platform like Mashvisor can turn data into clear, actionable visual information.

Visualizing data is crucial for understanding market opportunities in short-term rentals. Map interfaces help users analyze city or regional performance, indicating areas that are highly profitable or have strong demand. This simplifies market analysis, guiding investors to potential investment locations aligned with their goals.

This kind of map interface is incredibly helpful. Instead of sifting through spreadsheets, you can look at a city or region and immediately see which areas are performing well, which are less profitable, or where there might be a high demand for rentals. Different colors or shades on the map can represent average rental income, occupancy rates, or even the potential return on investment for properties in those specific neighborhoods. This visual aid simplifies the complex task of market analysis, making it accessible even to those who are new to real estate investing. It allows investors to quickly narrow down their search, focusing their efforts on areas that align with their investment goals. This visual strategy is a game-changer for finding those "potential investment locations" that promise strong returns.

Getting Specific: Location-Based Insights and Hidden Gems

While global data gives us a fantastic overview, true success in the short-term rental market often comes down to understanding local nuances. What works in one city might not work in another, and even within the same city, different neighborhoods can have vastly different rental dynamics. This is where tools that offer data for specific locations become incredibly powerful, allowing investors and hosts to dive deep into regional trends and uncover hidden gems.

Take, for example, the detailed information provided by platforms like PriceLabs. They don’t just offer general insights; they can give a really specific deep dive into regional trends. A great example of this is their Whole Country, Malaysia STR Market Performance Analysis6. This kind of report allows users to explore the ins and outs of a particular country or even specific regions within it. For someone looking to invest in Malaysia, this means understanding average daily rates across different states, seeing which cities have the highest demand, and knowing how seasonal variations impact bookings. It helps paint a very clear picture of the market conditions, enabling investors to make decisions that are finely tuned to the local environment.

Going even further, sites such as AirROI provide incredibly granular, location-specific Airbnb data. Imagine being able to see booking trends, average prices, and even the types of properties available right down to a specific city or district. For example, by looking at Kuala Lumpur’s data, an investor can understand exactly what kind of properties are most popular, what prices guests are willing to pay, and which neighborhoods have the best occupancy rates. This kind of targeted market assessment is invaluable. It helps investors not just find a property, but find the right property in the right place at the right time. It ensures that their investment is aligned with actual market demand, significantly increasing their chances of success7.

These hyper-local analytics are like having a magnifying glass for the market. They allow investors to spot micro-trends that might be missed in broader analyses, identify underserved niches, and tailor their rental strategies to perfectly match the local demand. This level of detail is not just helpful; it’s a critical advantage in a competitive market where every percentage point of occupancy and every dollar of rental income counts. With the right AI and property data analytics, you can unlock new opportunities in any location.

The Eastern Promise: High Returns in Asian STR Markets

While the global STR market offers opportunities everywhere, recent analysis has pointed a spotlight on a particularly exciting region: Asia. It seems some Asian markets are truly providing excellent returns, making them incredibly attractive to savvy short-term rental investors.

This fascinating insight was highlighted in a recent report from a highly respected source: CNBC. Imagine discovering which cities are offering the highest profits for vacation rentals! This kind of analysis is a goldmine for anyone looking to expand their investment horizons. It suggests that factors like growing tourism, economic development, and perhaps a relatively newer or less saturated STR market in certain areas are contributing to these impressive returns8.

The report likely dives into specifics, detailing which particular cities or regions within Asia are leading the pack. It might explain why places like a bustling metropolis, a serene coastal town, or a culturally rich historical area are yielding such strong results. For investors, knowing these specific locations can significantly narrow down their search and help them focus their resources on markets with proven profitability. It encourages them to look beyond traditional investment hotspots and explore dynamic new frontiers.

This kind of detailed regional analysis isn't just about showing where the money is; it also offers clues about what makes a short-term rental market thrive. Is it the type of travelers these areas attract? The cost of living? The local hospitality and infrastructure? Understanding these underlying factors can help investors apply similar thinking to other emerging markets around the world. It’s a powerful reminder that while data gives us the numbers, expert analysis helps us understand the story behind those numbers, pointing us towards the next big opportunity in the global short-term rental space.

Peering into the Future: The Magic of Rental Forecasting

In the fast-paced world of short-term rentals, simply knowing what happened yesterday or what's happening today isn't enough. To truly stay ahead, property owners and investors need to anticipate what's coming next. This is where the magic of rental forecasting tools comes into play, using advanced analytics to predict future performance.

One of the most exciting developments in this area comes from a leading name in the industry: AirDNA. This news is a big deal because it means that tools are constantly getting smarter, better able to predict how well a rental property will perform9.

Imagine you're thinking about buying a property to turn into a short-term rental. How do you know if it will be profitable next year? Or even next month? That's where Rentalizer shines. It uses loads of data – like historical booking trends, seasonal demand, local events, and even how similar properties are priced – to give you a really good idea of how much income that specific property could generate in the future. It’s like having a very smart fortune teller, but instead of tea leaves, it uses millions of data points!

This kind of predictive power is incredibly valuable. For potential investors, it helps them evaluate properties with much greater confidence, reducing the risk of making a bad investment. They can input an address and get an estimated future revenue, helping them decide if the property truly meets their financial goals. For existing property owners, forecasting tools help them adjust their pricing strategies, plan for upcoming slow periods, and maximize their earnings during peak seasons. If the tool predicts high demand for a specific weekend, they can raise their prices. If it predicts low demand, they might offer discounts or special packages to attract guests.

The evolution of tools like Rentalizer shows just how far short-term rental analytics have come. They are no longer just reporting on the past; they are actively helping to shape the future success of countless rental properties around the world. This means smarter decisions, better financial outcomes, and a more predictable income stream for everyone involved in the short-term rental economy.

The Curious Case of Regulations: A Double-Edged Sword?

While data analytics helps us understand markets and predict performance, another powerful force shapes the short-term rental landscape: regulations. Cities and governments around the world often introduce rules to manage STRs, hoping to address issues like housing affordability or neighborhood disruption. However, new analysis suggests that these regulations don't always have the intended impact, sometimes leading to surprising and even counterproductive results.

A really interesting piece of news highlights this complexity: New analysis shows stringent STR regulations have failed to improve the housing situation in Amsterdam and Barcelona10. These are two major European cities that have implemented some very strict rules on short-term rentals, hoping to free up more homes for long-term residents. For example, regulations might limit how many nights a year a property can be rented out, or require special licenses that are hard to get.

The analysis, however, tells a different story. Despite these tough rules, the desired outcome – a noticeable improvement in the housing situation for local residents – hasn't materialized as expected. This is a crucial finding because it suggests that the relationship between STR regulations and the housing market is far more complex than it might seem. It challenges the assumption that simply restricting short-term rentals will automatically solve housing problems.

Why might this be the case? The analysis might point to various factors. Perhaps the number of STRs wasn't large enough to significantly impact the overall housing supply. Or maybe other market forces, like economic conditions, population growth, or a general shortage of new housing construction, are playing a much bigger role. It could also be that strict regulations simply push short-term rentals underground, making them harder to track and regulate effectively, or they discourage legitimate hosts from operating, paradoxically harming local economies that benefit from tourism.

This particular finding is a powerful reminder that policies, even when well-intentioned, need to be carefully evaluated using data. It underscores the importance of ongoing analysis to understand the real-world effects of regulations on both the short-term rental market and the broader housing landscape. It’s a complex puzzle, and only with thorough data and careful study can we truly understand the full picture.

Streamlining Success: Solutions for Effective STR Management

Managing short-term rental properties can be a lot of work. From handling bookings and guest communication to managing cleaning schedules and maintenance, there are many tasks to juggle. That's why smart solutions designed to streamline these operations are becoming more and more important for hosts and property managers.

A notable example of a company stepping up to provide such support is Avenu Insights & Analytics. They recently launched a specialized tool for this very purpose: Avenu Insights & Analytics launches short-term rental solution11. This kind of solution is a game-changer because it helps property owners and managers handle the day-to-day operations of their rentals more effectively.

What exactly do these solutions do? They can offer a wide range of features, such as:

- Automated Communication: Imagine messages going out to guests automatically for check-in instructions, welcome notes, or even reminders about check-out. This saves a lot of time!

- Booking Management: Keeping track of all bookings, cancellations, and calendar availability across different platforms (like Airbnb and Vrbo) can be tricky. A good solution brings it all into one place.

- Financial Reporting: Easily track income, expenses, and profitability to get a clear picture of your business's financial health.

- Compliance Tools: With regulations always changing, these solutions can help ensure that properties are following all local rules and tax requirements, reducing stress for owners.

- Task Management: Schedule cleanings, organize repairs, and assign tasks to your team members, making sure everything runs smoothly between guests.

By providing these kinds of tools, companies like Avenu Insights & Analytics are not just making life easier for property owners; they are helping them run more professional and profitable businesses. When operations are smooth, guests are happier, and property owners can focus on what matters most: growing their short-term rental empire. These solutions are a crucial piece of the puzzle, turning the complex challenge of STR management into a much more manageable and efficient process.

The Wisdom of the Crowd: Community Insights into Analytics Tools

While professional platforms and official reports provide powerful data, sometimes the most honest and practical insights come from the very people using these tools every day. The short-term rental community, especially vibrant online forums, offers a unique perspective on what works, what doesn’t, and where to find the best free resources.

A fantastic example of this community wisdom can be found in discussions like those on Reddit. While less authoritative than a research paper or a company announcement, these discussions are incredibly valuable for understanding user preferences for analytics tools. They offer a grassroots perspective, shedding light on the real-world needs and challenges faced by actual Airbnb hosts and small-scale investors12.

In these forums, hosts share their experiences, recommending tools they've found useful, warning others about platforms that didn't meet their expectations, and often discussing ways to get valuable insights without breaking the bank. People might talk about:

- User-friendliness: How easy is the tool to understand and navigate?

- Accuracy: Does the data seem reliable and up-to-date?

- Feature set: Does it offer the specific reports or metrics they need?

- Cost-effectiveness: Are there good free options, or are paid subscriptions truly worth the money?

For example, someone might rave about a simple, free browser extension that gives quick pricing estimates, while another might debate the merits of a comprehensive paid service. These conversations help newcomers understand the landscape of tools available and weigh the pros and cons from a user's perspective. It's like asking a group of friends for their favorite apps – you get honest, unfiltered opinions.

These community-driven insights are a powerful complement to official reports and product descriptions. They help fill in the gaps, offering practical tips and real-world feedback that can be invaluable for anyone looking to navigate the world of short-term rental analytics. They remind us that while data is key, the experiences of the people using that data are equally important in shaping the future of the STR market.

The Future is Bright: Navigating the Short-Term Rental Horizon with Analytics

As we've journeyed through the dynamic world of short-term rentals, one truth has become crystal clear: Short-Term Rental Analytics are not just a useful accessory; they are the very engine driving success in this exciting market. From understanding broad market shifts to pinpointing the most profitable properties, data empowers everyone from individual hosts to large-scale investors to make smarter, more informed decisions.

We've seen how powerful platforms like AirDNA, Airbtics, and Mashvisor transform raw numbers into actionable insights, helping users spot trends, analyze performance, and identify profitable opportunities. The ability to dive deep into location-specific data, as offered by tools like PriceLabs and AirROI, is crucial for understanding the unique characteristics of different markets, whether you're looking at specific cities or exploring promising regions like the high-return Asian markets highlighted by CNBC.

The future of STR analytics is also incredibly exciting, with innovations like AirDNA's upgraded Rentalizer pushing the boundaries of rental forecasting. Being able to predict future performance allows investors to plan with greater confidence and optimize their strategies ahead of time. Meanwhile, effective management solutions from companies like Avenu Insights & Analytics are streamlining operations, making the day-to-day running of short-term rentals more efficient and less stressful.

However, our journey also revealed the complexities that data can uncover, such as the surprising findings from Airbnb's analysis regarding STR regulations in cities like Amsterdam and Barcelona. This shows that data doesn't just provide answers; it also sparks important questions and encourages deeper thinking about the real impact of policies. And let's not forget the invaluable wisdom shared by the community itself, with discussions on platforms like Reddit offering practical insights into the tools that truly work for everyday hosts.

In an industry that continues to evolve at lightning speed, staying informed and leveraging the power of data is no longer an option – it's a necessity. For investors seeking their next profitable venture, for hosts aiming to maximize their earnings, and for travelers looking for the perfect stay, short-term rental analytics provides the compass and the map. The future of short-term rentals is bright, data-driven, and full of incredible possibilities, waiting to be unlocked by those who understand its true power.

Frequently Asked Questions

Question: What is Short-Term Rental Analytics?

Answer: Short-Term Rental Analytics refers to the use of data and tools to understand market trends, optimize pricing, assess property performance, and make informed decisions in the short-term rental industry.

Question: How do analytics help in finding profitable STR properties?

Answer: Analytics platforms provide insights into occupancy rates, average daily rates, revenue, and local demand for specific areas, helping investors identify undervalued properties or emerging hotspots with high earning potential.

Question: Are there free tools for STR analytics?

Answer: While many comprehensive platforms offer paid subscriptions, community forums and some websites might provide discussions or limited free tools and resources for basic short-term rental data analysis.

Disclaimer: The information is provided for general information only. JYMS Properties makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.